Switching from HMO/EPO to HDHP Health Insurance

|

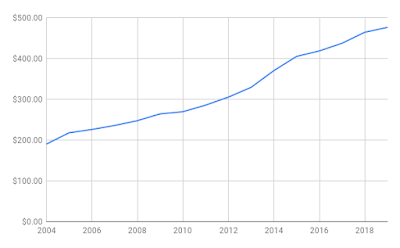

| WUSTL Family HMO Premiums 2004-2019 |

It is open enrollment time at good old Washington University, and for the first time I have switched from the HMO/EPO choice we have been using forever to the HDHP (high deductible health plan) that the university is offering and obviously pushing. The university is even contributing $800 each year to our HSA for the family plan ($400 for single plans), and with the EPO premiums now about 3.5 times the HDHP premiums ($475.79 vs $136.89) we decided it was time to switch.

Since I have been with the university over 15 years and they now store all our old paystubs on line, it was easy for me to extract the data to see how the family HMO premiums have increased over time. Back in 2004, the HMO premiums were only $189.75 per month which was less than 5% of my gross salary. For 2019 the $475.79 represents a 150% increase whereas my university salary has only increased about 70% over those 15 years. This now represents almost 7% of my salary, whereas the HDHP premiums would be less than 2% of my current salary. We have decided to contribute $3600 per year to the HSA which means $300 per month. That amount plus the HDHP premiums adds up to $436.89 which is still $40 per month less than the EPO plan premium. Plus we get to keep and roll over whatever remaining HSA balance we do not spend this year. You cannot beat that deal!

Being the all powerful online calculator creator, I was thinking of creating one of my own to compare HMO/EPO plans versus HDHP plans, but I found a good one here. Using it I calculated that the HDHP plan would definitely cost us less after-tax and makes a lot more sense for us.

Comments