Obama wants to tax 529 plan earnings to pay for the "Free" Community College plan

UPDATE: Well, that did not take long, the Obama administration has already decided they will leave 529 savings plans alone. So much for my previous post which is now no longer valid:

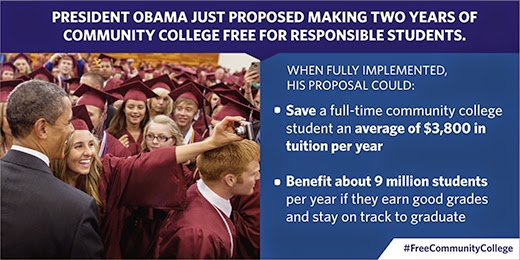

Since I work in higher education and also have a son who is about to start college this year, I am always interested in the latest news regarding higher education. When President Obama announced the plan to allow everyone to receive two "free" years of community college, everyone was curious where the funds would come to pay for the plan. It appears the answer is by taxing withdrawals made by those of us invested in 529 college savings plans like the Missouri MOST plan. The idea is that earnings from the plans would be taxed when withdrawn, and those taxes could help fund the free community college plan. I was unaware that less than 3% of U. S. families have 529 accounts, and they are most heavily used by more affluent savers. I found a very interesting report from the General Accounting Office that has all sorts of great numbers about the current state of 529 plans, who uses them and how much assets they have invested in them. I just love all those statistics!

One interesting by product of Obama's "announcement" may be that it may actually boost 529 plan contributions before the new changes are approved (which will likely be never.) I like Joe Hurley's ideas about this on his always interesting site, savingforcollege.com. From Parenting 101: There is no better way of getting somebody to want something than by threatening to take it away. Once families realize what a great deal 529 plans are as they stand, perhaps they will save more now before their tax advantages become diminished.

If you want to calculate how much you need to save for college, you know where to go - my tuition calculator at my handy, dandy online calculators site as always! I have to keep shamelessly promoting myself, just like a politician in D.C!

Comments