Paid off the Mortgage... Again!

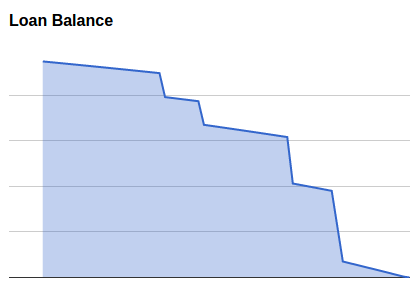

As a person who loves analyzing personal finance data, like the balance and interest paid on our mortgage, I am both excited but also sad to say we have just paid off the mortgage on our current house. We had actually paid off the mortgage on our previous home years ago, but after we bought our current residence several years ago, we decided to acquire another mortgage loan to cover some of the cost on our current, more expensive home. But now, after a few accelerated payments we have paid it off so we are again debt free. The graph above shows the actual declining loan balance of our loan over time (pulled from a Google spreadsheet I developed) and the 4 sharp declining periods shows the 5 months when we had added large extra chunks of principal to our payments to accelerate the payoff of our loan. Two of those months are back to back (the last two) so that looks like one really big plunge where it is really two of them.

Some people would therefore think I would always be a fan of paying off people's mortgages as fast as possible, but that is definitely not the truth at all. When you are young and first become a homeowner, you can most likely do much smarter things with your extra money then prepaying your mortgage like investing. In the late 1990's when I worked at a biotech company, we were lucky to have a brief one year period where our stock price was going through the roof and our stock options were worth a ton. Some of the 20 somethings working there asked me if they should cash some of their options and pay down their mortgages. I said an emphatic "NO!" to them - they should cash some of it out and reinvest it in something more stable than our crazy biotech stock. A year or so later I hope some of them did exercise their options then since our stock dropped like a rock, and we were shut down a couple years later. At the time I exercised a bunch of my options and invested it in our kids (contributed the maximum to the Missouri MOST 529 program for a couple years), invested the maximum to our Roth IRA's for a few years, invested more in our brokerage account and upped my 401K contributions to 20% . That was back when I was in my 30's so that made a lot more sense.

When our biotech company went belly up locally, they at least were very kind in giving me a very generous severance package. We saved much of that in cash until I found my current position at the university, but once I was established in the new position, we invested some of what remained in the Missouri MOST plan, I hiked my 403b contributions to a healthy 25% of my income, and we used some of the remainder to help buy a new minivan for the family (we are still using that vehicle too!) After a few years, when we hit 40 we realized we were pretty well invested and it did make sense to start paying down our mortgage, which had a rate of 7.25% and was starting to look pretty pricey (in the early to mid 2000's.) We considered refinancing, but with closing costs and the already not so large balance on our loan, it made more sense just to pay it down as we could. So by the time we were in our early 40's we had paid off the mortgage on that previous house, but only because we were already investing a lot in the stock market in our retirement funds, our brokerage account and even our kids' college funds.

When we decided to buy our current house in 2008, we actually could have paid cash for it simply by selling a hefty portion of our stocks from our brokerage account. But of course, that would have been an idiotic thing to do! We would have had to sell a much larger amount of stock (to cover capital gains taxes) and our brokerage account would have shrunk to just about nothing. Plus we knew once we sold our existing loan free house we could use the proceeds from the sale to cover a large percentage of the cost of the new house. So we again joined the world of the indebted by taking out an interest only "bridge" loan until we sold our house. Once we sold our previous house we used the proceeds from the sale to help us refinance to a smaller 20 year loan, this time at 4.91%, much lower than our old mortgage rate, but slightly above market for 2009 since it had a balance under $100K. We used Schwab Bank who did a great job and who I highly recommend. The Schwab Bank folks knew we had more in our brokerage account than the initial balance of our loan, but it still made sense to take out the loan. Why use stocks and funds that could probably grow substantially over time as opposed to borrowing at a tax deductible 4.91%?

However over the past few years, we saw one child graduate from college, and now our second will start college this year. As we looked at the calendars and our mirrors, we hit the next decade in age (yes, the big 50!) and we realized the next big financial goal on our horizon was retirement. Our mortgage balance had shrunk to just about nothing, so it was time to just get rid of it. So now I again no longer have a personal loan I can track on my own online loan calculators. I used to love checking how quickly we could pay it off, how much interest we could save and so forth, but now it would all be hypothetical since we cannot save any more mortgage interest and we have no loan to accelerate! What can I calculate now?

Some people would therefore think I would always be a fan of paying off people's mortgages as fast as possible, but that is definitely not the truth at all. When you are young and first become a homeowner, you can most likely do much smarter things with your extra money then prepaying your mortgage like investing. In the late 1990's when I worked at a biotech company, we were lucky to have a brief one year period where our stock price was going through the roof and our stock options were worth a ton. Some of the 20 somethings working there asked me if they should cash some of their options and pay down their mortgages. I said an emphatic "NO!" to them - they should cash some of it out and reinvest it in something more stable than our crazy biotech stock. A year or so later I hope some of them did exercise their options then since our stock dropped like a rock, and we were shut down a couple years later. At the time I exercised a bunch of my options and invested it in our kids (contributed the maximum to the Missouri MOST 529 program for a couple years), invested the maximum to our Roth IRA's for a few years, invested more in our brokerage account and upped my 401K contributions to 20% . That was back when I was in my 30's so that made a lot more sense.

When our biotech company went belly up locally, they at least were very kind in giving me a very generous severance package. We saved much of that in cash until I found my current position at the university, but once I was established in the new position, we invested some of what remained in the Missouri MOST plan, I hiked my 403b contributions to a healthy 25% of my income, and we used some of the remainder to help buy a new minivan for the family (we are still using that vehicle too!) After a few years, when we hit 40 we realized we were pretty well invested and it did make sense to start paying down our mortgage, which had a rate of 7.25% and was starting to look pretty pricey (in the early to mid 2000's.) We considered refinancing, but with closing costs and the already not so large balance on our loan, it made more sense just to pay it down as we could. So by the time we were in our early 40's we had paid off the mortgage on that previous house, but only because we were already investing a lot in the stock market in our retirement funds, our brokerage account and even our kids' college funds.

When we decided to buy our current house in 2008, we actually could have paid cash for it simply by selling a hefty portion of our stocks from our brokerage account. But of course, that would have been an idiotic thing to do! We would have had to sell a much larger amount of stock (to cover capital gains taxes) and our brokerage account would have shrunk to just about nothing. Plus we knew once we sold our existing loan free house we could use the proceeds from the sale to cover a large percentage of the cost of the new house. So we again joined the world of the indebted by taking out an interest only "bridge" loan until we sold our house. Once we sold our previous house we used the proceeds from the sale to help us refinance to a smaller 20 year loan, this time at 4.91%, much lower than our old mortgage rate, but slightly above market for 2009 since it had a balance under $100K. We used Schwab Bank who did a great job and who I highly recommend. The Schwab Bank folks knew we had more in our brokerage account than the initial balance of our loan, but it still made sense to take out the loan. Why use stocks and funds that could probably grow substantially over time as opposed to borrowing at a tax deductible 4.91%?

However over the past few years, we saw one child graduate from college, and now our second will start college this year. As we looked at the calendars and our mirrors, we hit the next decade in age (yes, the big 50!) and we realized the next big financial goal on our horizon was retirement. Our mortgage balance had shrunk to just about nothing, so it was time to just get rid of it. So now I again no longer have a personal loan I can track on my own online loan calculators. I used to love checking how quickly we could pay it off, how much interest we could save and so forth, but now it would all be hypothetical since we cannot save any more mortgage interest and we have no loan to accelerate! What can I calculate now?

Comments