Not too bad 2010 and here's to a better 2011!

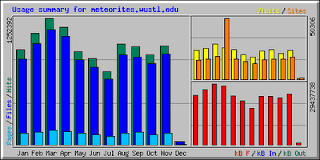

With only one more day in the financial markets for 2010 it looks like the S&P 500 will end 2010 with an annual gain of about 13% to close over 1250 after starting the year a little over 1100. Whereas the 13% gain is a good number, many will still lament over the peak in 2007 when the index was near 1550. Unfortunately that will likely never occur again so it is not productive trying to figure out what return is necessary to get us back to that point (unless you just want to calculate it for fun !). If you instead look at the S&P 500 index for the past 40 years (since 1970, you will see that our current level is really not too bad. If you track the linear increase from say 1982 to 1995, if you interpolate to the end of 2010, the line would likely end lower than it currently is right now. The massive peak in 1998 to 2000 and then in 2006/2007 has skewed people's perceptions of what long term growth should really look like. I love Google Finance 's ability to generate t...